Media Enquiries

Megan Landauro

Cassandra Geselle

ING

60 Margaret Street

Sydney NSW 2000

Media Enquiries

Megan Landauro

Cassandra Geselle

ING

60 Margaret Street

Sydney NSW 2000

published 25 Jun 2013

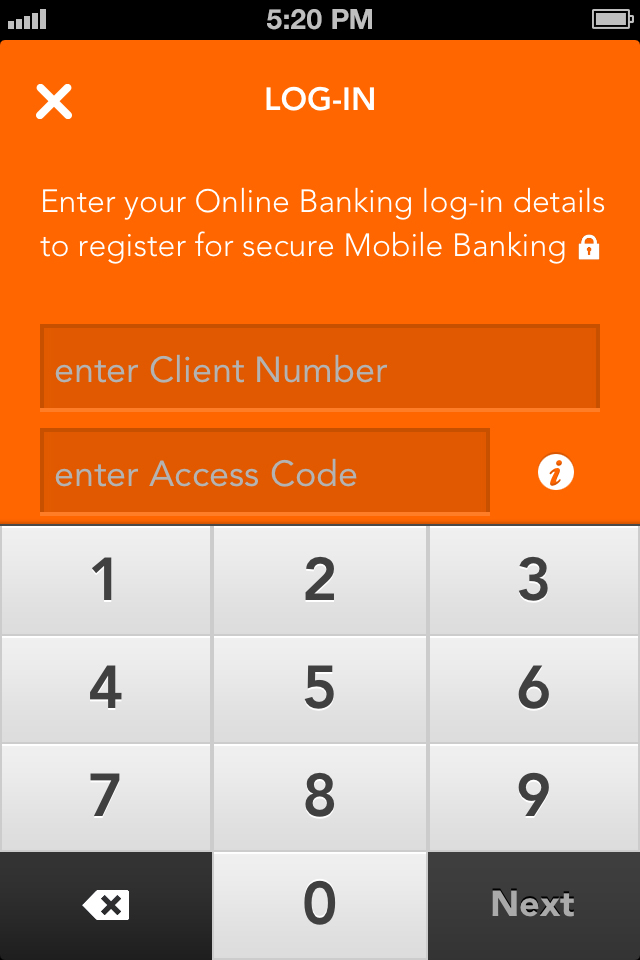

Mobile to overtake web at online bank

Mobile banking sees 280% lift at ING DIRECT

Tuesday, 25 June 2013: ING DIRECT has launched a new mobile app designed to meet the demand of its growingly mobile customer base, in which the bank saw a staggering 280% increase in mobile interactions in 2012.

“The consistent trend in web visits has been around 15% year on year, but this spike in mobile interactions is proof of ever-growing consumer demand and comfort to be able to ‘do’ while on the go,” said Executive Director Distribution at ING DIRECT, Lisa Claes.

The app, collaboratively developed and designed by ING DIRECT’s own digital team with Oakton and Deloitte Digital, allows customers to view their account balance across all their products before logging in and transfer money to anyone in Australia – with email or SMS notification.

“For a bank where 95% of customer transactions occur online, and 39% of those are via mobile and increasing, this is absolutely the next step for a branchless bank like ING DIRECT.

“We know that our mobile customers bank with us more regularly and we want to make that experience easy and intuitive to ensure customers have visibility and control over their personal finances. As such we have designed our app to appeal specifically to customers wanting transparency, immediacy and simplicity in their core banking functionality” said Claes.

Deloitte Digital Partner Jonathan Rees said: “Deloitte research released this month shows that 30% of Australian across all ages (14-75) use their mobile for banking at least weekly – double last year’s usage. The ING DIRECT app is all about creating something intuitive for customers ‘on the go’.

Our Australian experience is reflected in global trends which show the growing benefits of mobile banking. A survey of mobile banking users in Europe* shows:

- 66% “feel more in control” of money because of mobile banking

- 62% of agree they pay their bills on time more often

- 84% mobile banking users agree they check their account more often.

“Customers were invited to test the app throughout the design and development phase as we saw the customer experience as the most critical piece to the success of the new app. We were particular about choosing the features that mattered most to customers and designing them in a very simple way,” said Claes.

“The uniqueness of the solution implemented by Oakton for ING DIRECT is in the combination of security, performance and responsiveness based on latest technology available to deliver the new app.” said Neil Wilson, CEO, Oakton.

The new ING DIRECT Mobile Banking app is available for iPhone and Android.

*This survey was conducted by Ipsos on behalf of ING Group between 18 April and 15 May 2013. European consumer figures are an average, weighted to take country population into account. 12 countries were surveyed, bringing the total sample to 11,724.

Media contact:

Caroline Thomas

PR Manager, ING DIRECT

+61 2 9018 5160

+61 413 317 225

caroline.thomas@ingdirect.com.au

About ING DIRECT

ING DIRECT pioneered branchless banking in Australia by offering the first online, high interest, fee free savings account. Our low cost operating model allows us to pass these savings on to the customer in the form of great value products and services. Today, ING DIRECT has more than 1.4 million customers with $29 billion in deposits and $38 billion in mortgages and a range of products including transaction accounts and superannuation. Please note ING DIRECT is never abbreviated to ING.

Media Enquiries

Megan Landauro

Cassandra Geselle

ING

60 Margaret Street

Sydney NSW 2000